Customer payment preference is shifting from offline to online systems. This condition leads business owners to create an appropriate online payment flow. The payment gateway has become a one-stop solution for business owners to connect their businesses to various online payments through one simple integration.

Instead of integrating with various bank partners to provide payment channels for your customers, payment gateways make it possible for your business to connect with many payment channels simultaneously.

But, what is a payment gateway? How does it work to make such integration for your business payments? Get to know how through a simple explanation in this article.

What Is A Payment Gateway?

A Payment Gateway (PG) is a digital system service that helps business owners to receive payments from customers. This service functions as a liaison between customers, banks, and merchants so that the transaction process can take place more easily and effectively.

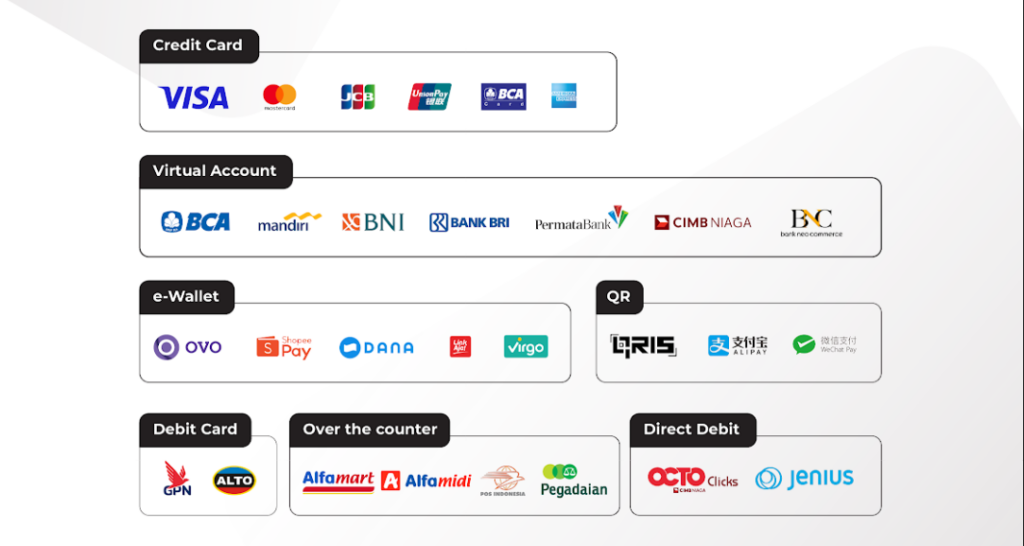

This payment service becomes the bridge that enables payment from customers’ preferred payment method to business owners (merchants). PG service usually offers various payment methods that can be chosen to receive customer payments. Some of them include credit/debit cards, virtual accounts, e-wallets, QR payments, and so on.

How It Works

PG service can do both accepting and sending payment. The general term for sending payment service is disbursement. In this article, we are going to focus on how PG works on accepting money from customers to merchants.

Keep in mind that merchants can choose any preferred payment method to be displayed on the payment page for customer to pay their invoices. This is possible because of the integration that holds between the merchant and payment gateway provider.

Here is a simple flow of how the process works:

1. Customer Pays with the Preferred Method

Customer enter their invoice details which shows the amount of money they should pay on your website’s payment page. They can complete payment from this page according to a selected payment method.

2. Bank Receive Customers’ Funds

PG system then transmits the encrypted payment information to the payment network. The customer’s payment funds will be sent to the bank or e-wallet according to the customer’s payment choice. So the funds are not sent directly to the PG provider’s account.

3. Payment Gateway Performs Settlement

After that, PG will send authorization requests to bank or e-wallet partners to verify and process the customers’ payments. If the payment is successfully processed, PG will submit settlement funds. This process usually takes 2 working days.

4. Fund Settlement to Merchant Account

A Settlement process is held by transferring customers’ payment funds directly to the merchant’s bank account. The accepting payment process is finally completed. Settlement transfers usually run automatically without periodic requests from merchants.

Payment Gateway Benefits

PG service is designed for effective transaction processing which maximizes various benefits for your business. Here are some of the benefits you can expect:

1. Secure Payment System

The top-of-mind benefit of PG service is a secured payment system. All data used through the payment process is encrypted to prevent unauthorized access other than the business owners and customers.

So, both business owners and customers are protected from data breaches and minimize payment fraud such as carding or phishing.

2. Increase Transaction Effectiveness

PG service will provide an integrated dashboard for merchants to manage all of the transactions inside their business. Advanced payment technology also allows automated data recording to create real-time data reports for merchants.

This will increase transaction effectiveness because merchants will not need to collect data manually from scratch. Furthermore, if you have bigger transaction numbers that is prone to data errors.

3. Improve Customers’ Experience

Grab your customers’ various payment preferences in one simple payment page. Let your customers choose the payment method based on their needs and preferences. This condition leads customers to pay more fast and hassle-free.

Avoid canceled orders from customers because they cannot carry payment through manual bank transfer or cash-only payment.

4. Simplify Payment Integration

Connecting your website to various banks and e-wallets one by one might be costly and time-consuming. Furthermore, the amount of dashboards you have to maintain is also enormous. The payment gateway provides one-stop integration for merchants to connect their business with a variety of payment methods.

5. Local and International Payment

Business expansion might need an extensive payment system to support transaction processes. On the other hand, some industries also target specific international clients to run business transactions.

The advanced payment gateway can handle your needs for both local and international payment processes. So, it is vital to choose a reliable payment service provider who can

Payment Gateway Indonesia by iFortepay

iFortepay is a trusted payment gateway service provider in Indonesia with an extensive payment network and reliable security system. Every incoming online payment will be automatically verified. You can see the payment status of each invoice in the dashboard. Also, get access to monitor settlement transactions which are updated regularly.

We provide various payment channels which support local and international transactions. Choosing iFortepay as your reliable payment gateway partner enhances your payment process and management and ensures that your business transaction is running efficiently. You are advancing the way you pay with iFortepay. Learn more >>